This library centralizes every U.S. mortgage regulator—federal, state, and investor—with plain-English summaries of who they oversee, which rules matter most, and how to stay exam-ready. Your #1 action item: bookmark this page and use it as your regulator reference hub.

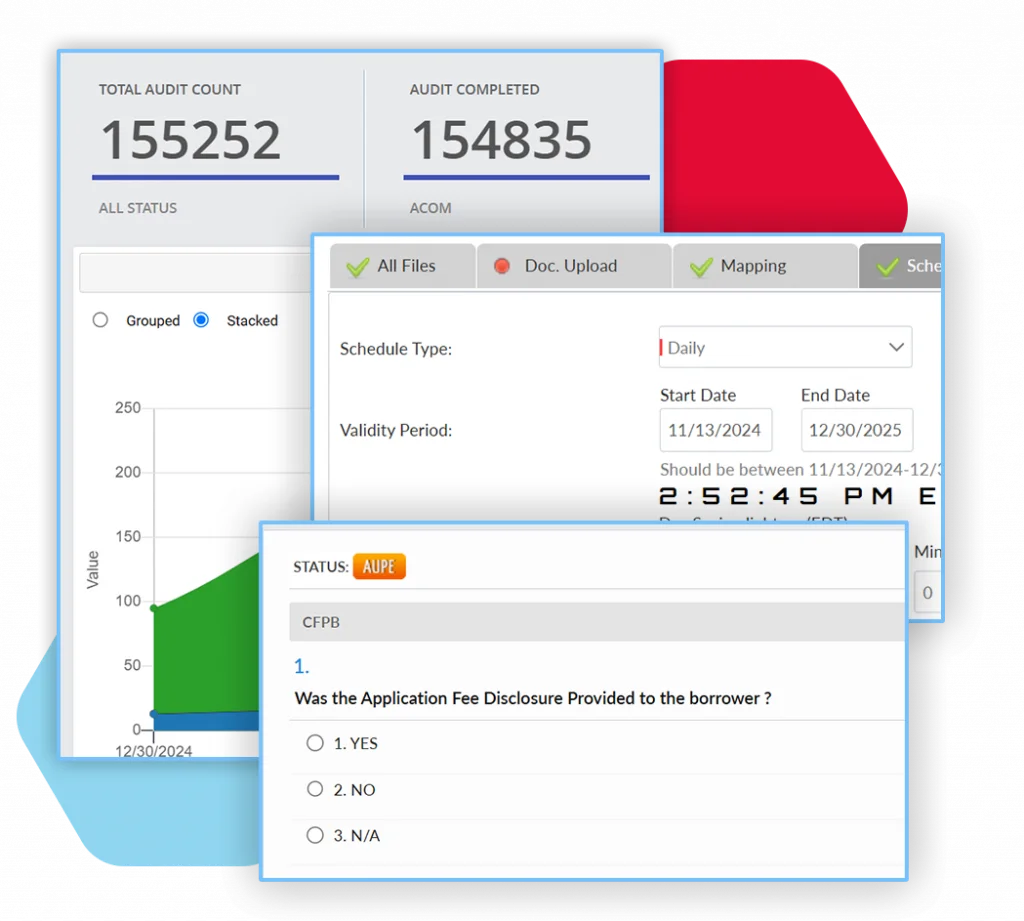

Determine which federal, state, and investor entities oversee your organization based on your business model, charter type, and geographic footprint.

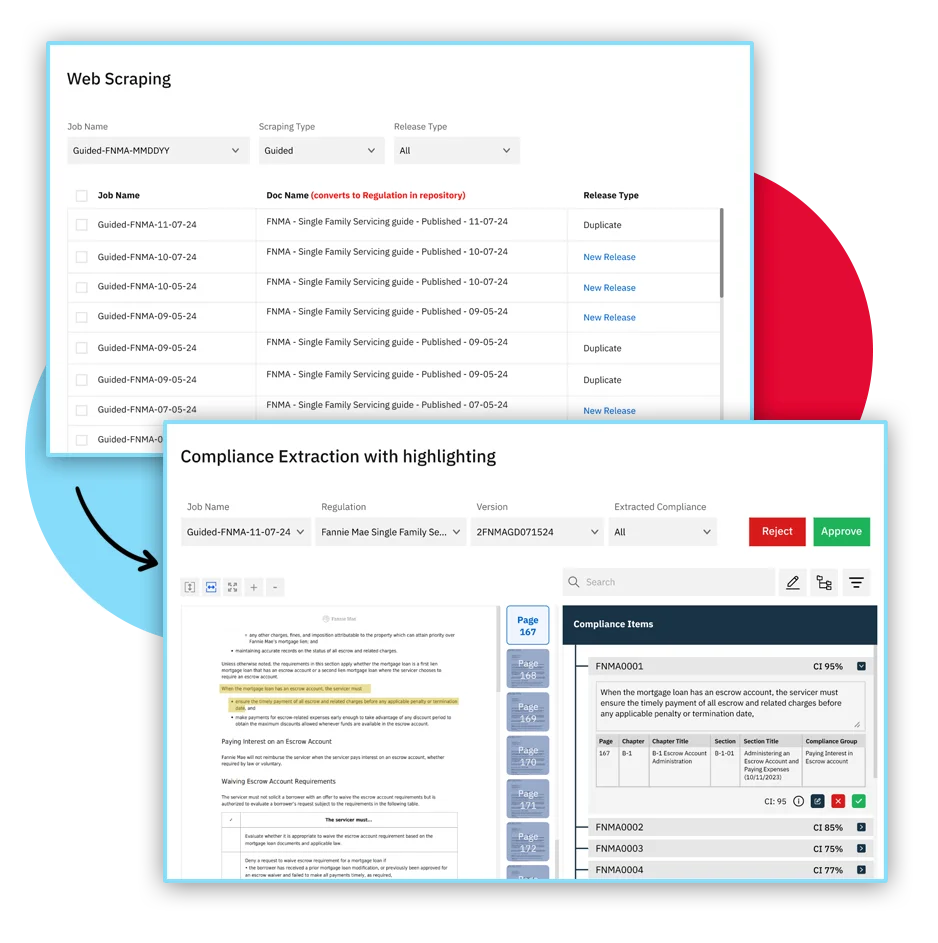

Study the primary regulations and bulletins that apply to your operations. Focus on CFPB rules, state licensing requirements, and investor guidelines.

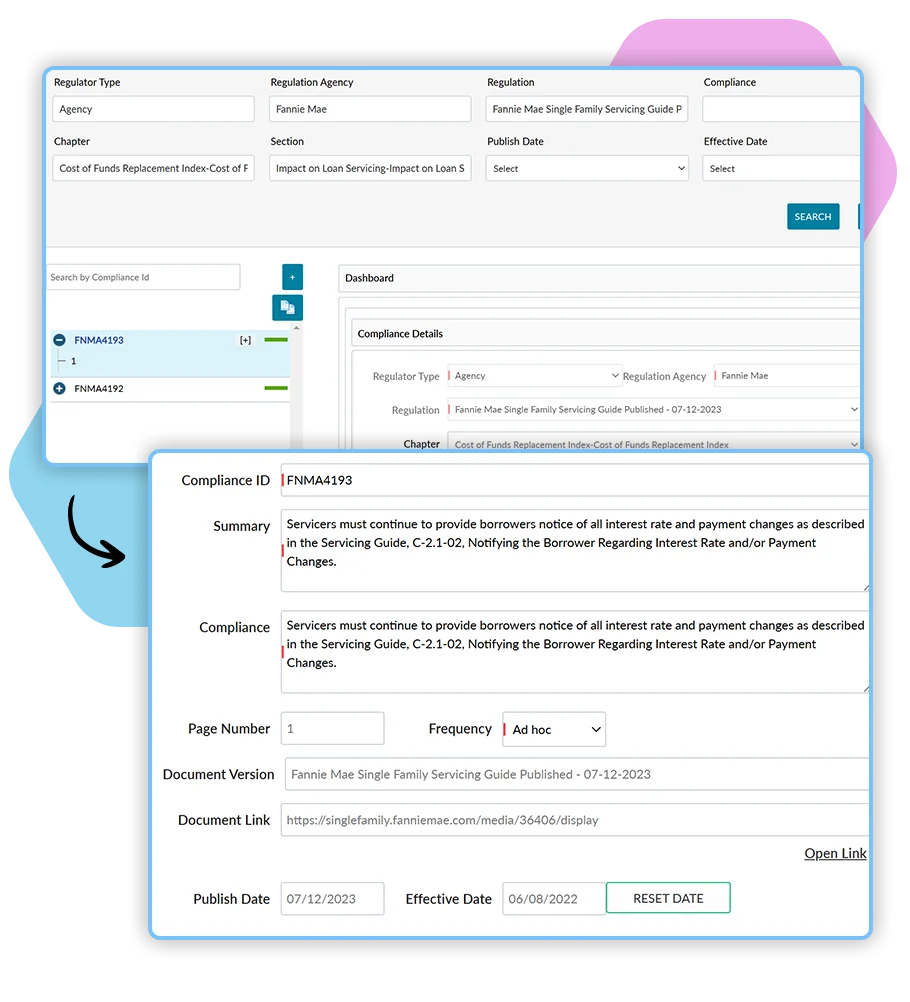

Set up systems to track regulatory changes, exam schedules, and compliance deadlines. Use automated tools to stay current with updates.

Keep comprehensive records of policies, procedures, training, and compliance activities. Ensure documentation is organized and easily accessible for examinations.